What the ideal investment portfolio looks like for different age groups

Get Guaranteed Returns After a Month^

Unlock the Power of Smart Investment!

-

Table of Contents

Table of Contents

Investing in your 20s

Investing in your 30s

Investing in your 40s

Investing in your 50s

Conclusion

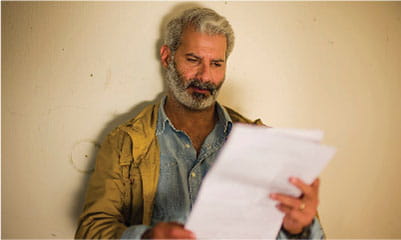

About Author

Give ₹1.5 Lakhs once & Get ₹2.74 Lakhs at Maturity^

-

Disclaimer

2Tax benefits are subject to changes in tax laws. Kindly consult your financial advisor for more details.

^ Scenario: Rs. 5,00,000 Single Premium (exclusive of GST). Male, Age 35, Plan Option A, Policy Term : 5 years

**Scenario: Rs. 1,00,000 Single Premium (exclusive of GST), Male, Age 32, Plan Option A, Policy Term : 10 years. Guaranteed Maturity Benefit: ₹196,916 at end of policy term. ABSLI Fixed Maturity Plan is a Non- Linked Non- Participating Individual Savings Life Insurance Plan (UIN: 109N135V03)

ABSLI DigiShield Plan (UIN 109N108V08) is a non-linked non-participating individual pure risk premium life insurance plan; upon Policyholder's selection of Plan Option 9 (Level Cover with Survival Benefit) and Plan Option 10 (Return of Premium [ROP]) this product shall be a non-linked non-participating individual life savings insurance plan.

ADV/5/22-23/312

Subscribe to our Newsletter

Get the latest product updates, company news, and special offers delivered right to your inbox

Thank you for Subscribing

Stay connected for tips on insurance and investments