Insurance Solutions for SME Businesses

-

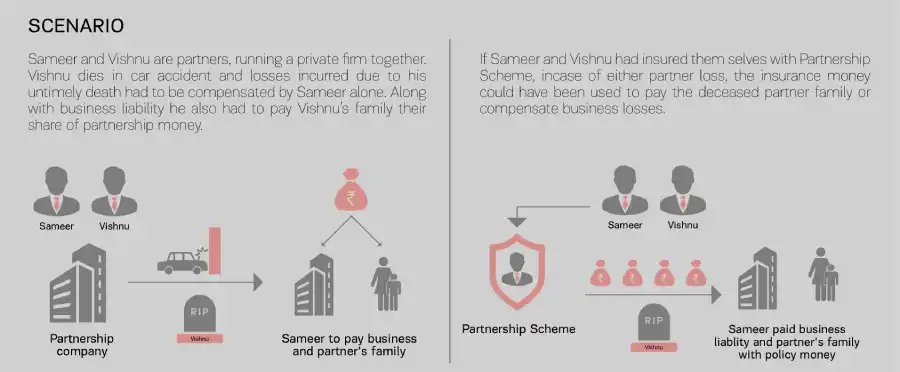

Ensures that working capital requirements are not

-

Compromised to buy out the share of the deceased partner

-

Risk mitigation & business continuity

-

Reduces the risk of partners having to bring

-

Additional funds to purchase the share of the deceased partner

-

(1) Tax benefits under section 37(1) of the Income Tax Act, 1961 - (1)Tax benefit is subject to changes in the tax laws, please consult your tax advisor for more details.

Disclaimer:

“The Trade Logo “Aditya Birla Capital” Displayed Above Is Owned By ADITYA BIRLA MANAGEMENT CORPORATION PRIVATE LIMITED (Trademark Owner) And Used By ADITYA BIRLA SUN LIFE INSURANCE COMPANY LIMITED (ABSLI) under the License.”

For more details on risk factors, terms and condition please read the sales brochure carefully before concluding the sale.

Aditya Birla Sun Life Insurance Company Limited (Formerly Birla Sun Life Insurance Company Limited) Registered Office: One Indiabulls Centre,Tower 1, 16th Floor, Jupiter Mill Compound, 841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013. Website:www.adityabirlasunlifeinsurance.com and toll-free no. 1800-270-7000. IRDAI Reg No.109 CIN: U99999MH2000PLC128110 ADV/11/19-20/1127

-

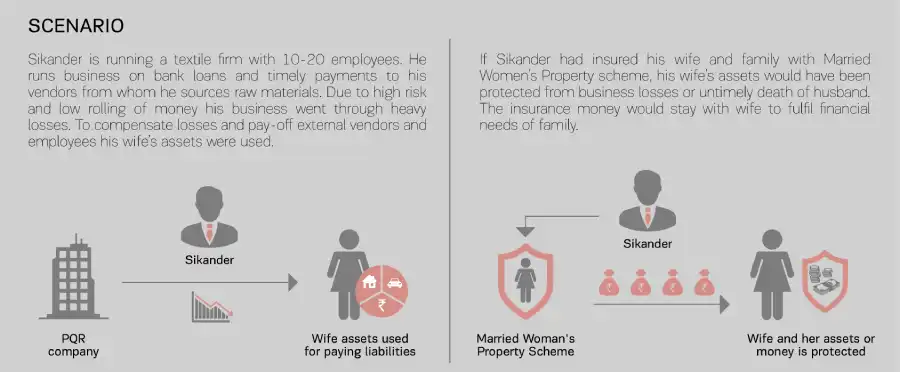

A tool to ensure your wealth is passed down only to your desired loved one/s

-

Helps create an insulated corpus for your beneficiaries

-

Ensure your family is protected against any future financial adversities

-

Estate planning tool

-

Desired allocation of corpus for intended beneficiaries

-

Help the family maintain a better lifestyle even in case of financial adversities

-

(1)Tax benefits under section 80C and 10 (10) D as applicable - (1)Tax benefit is subject to changes in the tax laws, please consult your tax advisor for more details

-

Corpus created which is insulated from the liabilities of your husband

-

Benefits under this policy will go to the life insured on any chosen nominee

-

(1)Tax benefits under section 80C and 10 (10) D as applicable - (1)Tax benefit is subject to changes in the tax laws, please consult your tax advisor for more details

Disclaimer:

“The Trade Logo “Aditya Birla Capital” Displayed Above Is Owned By ADITYA BIRLA MANAGEMENT CORPORATION PRIVATE LIMITED (Trademark Owner) And Used By ADITYA BIRLA SUN LIFE INSURANCE COMPANY LIMITED (ABSLI) under the License.”

For more details on risk factors, terms and condition please read the sales brochure carefully before concluding the sale.

Aditya Birla Sun Life Insurance Company Limited (Formerly Birla Sun Life Insurance Company Limited) Registered Office: One Indiabulls Centre,Tower 1, 16th Floor, Jupiter Mill Compound, 841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013. Website:www.adityabirlasunlifeinsurance.com and toll-free no. 1800-270-7000. IRDAI Reg No.109 CIN: U99999MH2000PLC128110. ADV/11/19-20/1126

-

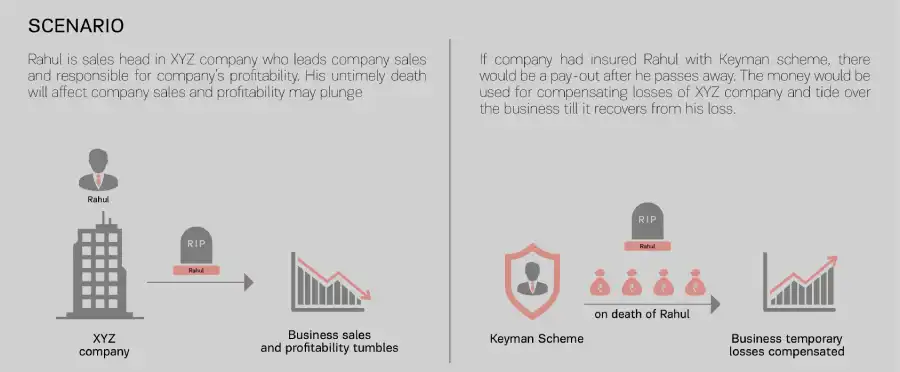

Safeguard the business from financial losses occurring due to death/critical illness of key employee

-

Risk mitigation & business continuity

-

Provides corpus for ex gratia payment to the family of deceased employee

-

Business protected on human capital can attract finance on favourable terms

-

Corpus for fresh hiring/pay off any liabilities

-

(1)Tax Benefit - (1)Tax Benefits are subject to changes in the tax laws, please consult your tax advisor for details

Disclaimer:

“The Trade Logo “Aditya Birla Capital” Displayed Above Is Owned By ADITYA BIRLA MANAGEMENT CORPORATION PRIVATE LIMITED (Trademark Owner) And Used By ADITYA BIRLA SUN LIFE INSURANCE COMPANY LIMITED (ABSLI) under the License.”

For more details on risk factors, terms and condition please read the sales brochure carefully before concluding the sale.

Aditya Birla Sun Life Insurance Company Limited (Formerly Birla Sun Life Insurance Company Limited) Registered Office: One Indiabulls Centre, Tower 1, 16th Floor, Jupiter Mill Compound, 841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013. Website: www.adityabirlasunlifeinsurance.com and toll-free no. 1800-270-7000. IRDAI Reg No.109 CIN: U99999MH2000PLC128110. ADV/11/19-20/1125

-

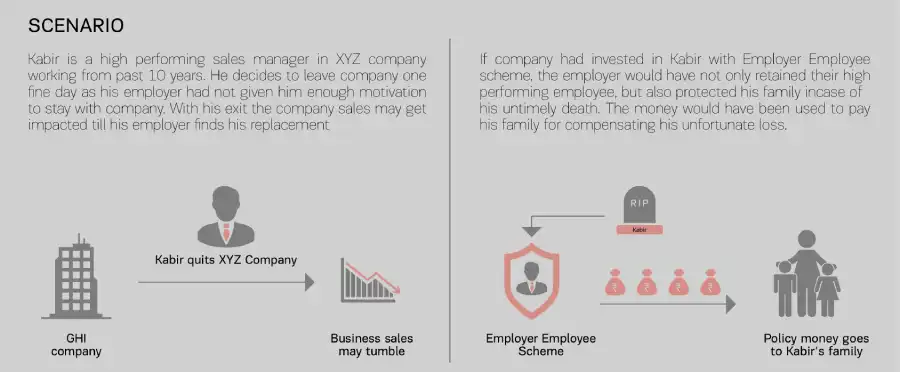

Gains employee’s loyalty & boosts employee morale

-

Enhances employee retention

-

Reward and promote employee engagement

-

Saves cost of hiring and training new employee

-

(1)Tax Benefit - (1)Tax Benefits are subject to changes in the tax laws, please consult your tax advisor for details.

-

Sense of financial security and performance reward

-

Financial Security for the dependants

-

Build retirement corpus

Disclaimer:

“The Trade Logo “Aditya Birla Capital” Displayed Above Is Owned By ADITYA BIRLA MANAGEMENT CORPORATION PRIVATE LIMITED (Trademark Owner) And Used By ADITYA BIRLA SUN LIFE INSURANCE COMPANY LIMITED (ABSLI) under the License.”

For more details on risk factors, terms and condition please read the sales brochure carefully before concluding the sale.

Aditya Birla Sun Life Insurance Company Limited (Formerly Birla Sun Life Insurance Company Limited) Registered Office: One Indiabulls Centre,Tower 1, 16th Floor, Jupiter Mill Compound, 841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013. Website:www.adityabirlasunlifeinsurance.com and toll-free no. 1800-270-7000. IRDAI Reg No.109 CIN: U99999MH2000PLC128110. ADV/11/19-20/1123