-

Loans

-

Housing Finance

-

Related Reads

What is Mortgage Loan?

What is Mortgage Loan? Home Improvement Loan: Everything You Need to Know

Home Improvement Loan: Everything You Need to Know What is a Loan Against Property?

What is a Loan Against Property?

-

Personal Finance

-

Personal Loan Eligibility Calculator

Are you eligible for a Personal Loan? Find out now!

CALCULATE NOWRelated Reads What is Personal Loan?

What is Personal Loan? Instant Personal Loan In India – What Is It And How To Apply?

Instant Personal Loan In India – What Is It And How To Apply? Debt Consolidation With a Personal Loan

Debt Consolidation With a Personal Loan

-

SME Finance

-

Related Reads

Types of MSME Loans for Your Business

Types of MSME Loans for Your Business A Guide to Startup Business Loans

A Guide to Startup Business Loans Things to Include In Your Business Loan Application

Things to Include In Your Business Loan Application

- Back

-

Housing Finance

-

Investments

-

Mutual Funds

-

-

Related Reads

Mutual Funds for NRIs: 4 Tax Rules You Should Know

Mutual Funds for NRIs: 4 Tax Rules You Should Know Systematic Investment Plan: Meaning, Advantages & Disadvantages

Systematic Investment Plan: Meaning, Advantages & Disadvantages Liquid Funds – Working, Benefits And Taxation

Liquid Funds – Working, Benefits And Taxation

-

-

Stocks & Securities

-

Related Reads

Understanding Bonds & Types of Bonds

Understanding Bonds & Types of Bonds Working of the trade price in the stock market

Working of the trade price in the stock market What is a Stockbroker? - Types & Their Role in Stock Market

What is a Stockbroker? - Types & Their Role in Stock Market

-

FD & Digital Gold

-

Related Reads

What Is FD? - Complete Guide on Fixed Deposit

What Is FD? - Complete Guide on Fixed Deposit Tax Saving FD - 10 Interesting Facts about Tax Saving Fixed Deposits

Tax Saving FD - 10 Interesting Facts about Tax Saving Fixed Deposits Fixed Deposits (FD) Benefits & Features

Fixed Deposits (FD) Benefits & Features

-

Tax Solutions

-

Related Reads

What Is FD? - Complete Guide on Fixed Deposit

What Is FD? - Complete Guide on Fixed Deposit Tax Saving FD - 10 Interesting Facts about Tax Saving Fixed Deposits

Tax Saving FD - 10 Interesting Facts about Tax Saving Fixed Deposits Income Tax on Interest on Fixed Deposit: What You Need to Know

Income Tax on Interest on Fixed Deposit: What You Need to Know

- Back

-

Mutual Funds

-

Insurance

-

Life Insurance

-

Human Life Value Calculator

Find out how much life insurance you need with our Human Life calculator

CALCULATE NOWRelated Reads What is Insurance ? Your Guide to Understanding Insurance in India

What is Insurance ? Your Guide to Understanding Insurance in India Insurance for Children: Does a Child Need Life Insurance?

Insurance for Children: Does a Child Need Life Insurance? All you need to know about Unit Linked Insurance Plans

All you need to know about Unit Linked Insurance Plans

-

Health Insurance

-

Related Reads

Super Top-Up Health Insurance Cover – All You Need to Know

Super Top-Up Health Insurance Cover – All You Need to Know Health Insurance for Senior Citizens

Health Insurance for Senior Citizens Maternity Insurance Plans – What it is All About

Maternity Insurance Plans – What it is All About

-

Motor Insurance

-

Related Reads

What is Motor Insurance? - Car Coverage, Claims & More

What is Motor Insurance? - Car Coverage, Claims & More Different Types of Car Insurance Policies and Their Coverage

Different Types of Car Insurance Policies and Their Coverage Common Exclusions that Your Car Insurance Will Not Cover

Common Exclusions that Your Car Insurance Will Not Cover

- Back

-

Life Insurance

-

Payments

-

Tools

-

My Track

-

Related Reads

What is Mortgage Loan?

What is Mortgage Loan? All You Need to Know About Mutual Fund Expense Ratio

All You Need to Know About Mutual Fund Expense Ratio Insurance for Children: Does a Child Need Life Insurance?

Insurance for Children: Does a Child Need Life Insurance?

-

ABC Of Money

-

ABC of Money

View All -

Related Reads

What is Mortgage Loan?

What is Mortgage Loan? All You Need to Know About Mutual Fund Expense Ratio

All You Need to Know About Mutual Fund Expense Ratio Insurance for Children: Does a Child Need Life Insurance?

Insurance for Children: Does a Child Need Life Insurance?

-

-

ABC Of Calculators

-

ABC Of Calculators

View All -

Related Reads

What is Mortgage Loan?

What is Mortgage Loan? All You Need to Know About Mutual Fund Expense Ratio

All You Need to Know About Mutual Fund Expense Ratio Insurance for Children: Does a Child Need Life Insurance?

Insurance for Children: Does a Child Need Life Insurance?

-

- Back

-

My Track

-

Quick Services

Life Insurance

Health Insurance

Mutual Fund

Home Finance

Personal Finance

- Personal

- Business

-

Corporates

-

Advisors

-

Investments

- Mutual Funds Advisors

- Stocks & Securities Advisors

-

Complete Money Solutions

- Select Advisor

-

Tools & Calculators

- Calculators

- SIP Calculator

- EMI Calculator

- Flexi Loan

- Money View

- Hybrid Funds

- Fund Of Funds

- Index Funds

Popular Searches

Trending Plans

Most Visited Product

Our Financial Solutions

Life Insurance

Health Insurance

Mutual Funds

Stock & Securities

Housing Finance

Personal Finance

SME Finance

Home Loan

Home Loan

Make your dream of owning a home a reality

Balance Transfer

Balance Transfer

Find a better interest rate for your existing home loan

Top-up Home Loan

Top-up Home Loan

Get the extra cash you need to finance your dream home

Loan Against Property

Loan Against Property

Empower your financial goals with the assets you already own

Construction Finance

Construction Finance

Finance your real estate project from foundation to finish

Quick Links

Related Reads

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

Personal Loan

Personal Loan

Get a Personal Loan instantly without any collateral

Aditya Birla SBI Card

Aditya Birla SBI Card

Get rewarded every time you shop

Flexi Loan

Flexi Loan

Get a flexible loan that adapts to your needs

Quick Links

Related Reads

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

Line of Credit

Line of Credit

Access the funds you need to grow your business

Unsecured Business Loan

Unsecured Business Loan

Get a loan for your business needs without providing collateral

Secured Business Loan

Secured Business Loan

Get loans for all of your business needs at attractive rates

Working Capital Demand Loan

Working Capital Demand Loan

Meet your business’s financial needs from a dependable source

Supply Chain Financing Solutions - Invoice Discounting

Supply Chain Financing Solutions - Invoice Discounting

Ensure your business always has a smooth cash flow

Quick Links

Business Loan EMI Calculator

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis, Diam Id.

CALCULATE NOW

Related Reads

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

Debt Funds

Debt Funds

Mauris Porta Arcu Id Tortor Pulvinar Cursus.

Equity Funds

Equity Funds

Mauris Porta Arcu Id Tortor Pulvinar Cursus.

ETF Funds

ETF Funds

Mauris Porta Arcu Id Tortor Pulvinar Cursus.

Hybrid Funds

Hybrid Funds

Mauris Porta Arcu Id Tortor Pulvinar Cursus.

Fund Of Funds

Fund Of Funds

Mauris Porta Arcu Id Tortor Pulvinar Cursus.

Index Funds

Index Funds

Mauris Porta Arcu Id Tortor Pulvinar Cursus.

Related Reads

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

Calculators View All

SIP Calculator

SIP Calculator

Mauris Porta Arcu Id Tortor Pulvinar Cursus.

EMI Calculator

EMI Calculator

Mauris Porta Arcu Id Tortor Pulvinar Cursus.

Flexi Loan

Flexi Loan

Mauris Porta Arcu Id Tortor Pulvinar Cursus.

Money View

Related Reads

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

Life Insurance

Life Insurance

Mutual Fund

Mutual Fund

Health Insurance

Health Insurance

Home Finance

Home Finance

Personal Finance

Personal Finance

Term Plan

Term Plan

Bring security and peace to life’s unpredictability

Retirement Plan

Retirement Plan

Get a guaranteed regular pension plus a lump sum on plan maturity

Savings Plan

Savings Plan

Build wealth over time with disciplined savings

Child Plan

Child Plan

Ensure your child’s future with a combo of investment and insurance

ULIP

ULIP

Get the benefits of insurance and wealth creation in one convenient plan

Related Reads

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

Related Reads

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

Mutual Fund Lumpsum Calculator

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis, Diam Id.

CALCULATE NOW

Related Reads

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

Open Demat Account

Open Demat Account

Create a Demat Account and start investing

IPO Calender

IPO Calender

Stay up-to-date with current and upcoming IPOs

Quick Links

Related Reads

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

Debt Funds

Debt Funds

Diversify your portfolio and reduce risk with Debt Funds

Equity Funds

Equity Funds

The smart way to invest in the stock market

ETF Funds

ETF Funds

Invest easily, diversify wisely, and grow your wealth

Hybrid Funds

Hybrid Funds

Strike the perfect balance between growth and stability

Fund Of Funds

Fund Of Funds

Maximise your returns with Fund of Funds

Index Funds

Index Funds

Follow the benchmark of smart investors to grow your wealth

Mutual Fund Lumpsum Calculator

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis, Diam Id.

CALCULATE NOW

Related Reads

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

Popular Searches

Trending Plans

Our Financial Solutions

Life Insurance

Health Insurance

Mutual Funds

Stock & Securities

Housing Finance

Personal Finance

SME Finance

Related Reads

All You Need To Know About Insurance Policy

All You Need To Know About Insurance Policy

Step 1

Step 2

Step 3

Finish

Empowering Transactions, Anytime, Anywhere

Pay for your online or offline transactions with a click with the ABCD app. Payments made easy with solutions that work anytime, anywhere!

Pay for Anything, Anywhere

Buy anything, spend anywhere. Pay with the ABCD app for everything!

Reasons to use ABCD App

Find out why ABCD App is your right payment partner

Multipay

Multipay

Never abort transactions when short on money. Transfer money from one bank account to another or divide the amount with multiple accounts and easily complete payment transactions.

UPI Lite

UPI Lite

Transfer money even without the internet using the ABCD App

UPI International

UPI International

Make international payments with ease.

QR code payments

QR code payments

Scan QR at your favourite offline shops and merchants and pay using the ABCD app.

Go digital while submitting corporate expenses

Go digital while submitting corporate expenses

Tag your corporate expenses for transactions made using the ABCD app. Don’t worry about losing bills and submitting proofs in a jiffy.

How to start paying with ABCD App?

You can power your payments via the ABCD app with just a few simple steps.

Download the ABCD App

Start by downloading the digital-first ABCD app and unlock a world of convenience

Create UPI ID

Create UPI Id to facilitate easy and secure fund transfers.

Link Your Bank Account

Link bank a/c in 1 click for uninterrupted payment services.

Ready to Go

That’s all! Empower your payments in a click with the ABCD app.

Aditya Birla’s Trust, you can rely on with confidence!

Trust

Bank on Aditya Birla’s trusted platform as your payment partner for hassle-free transactions.

Security

Experience secured payment gateways and pay without worries!

Safety

Protect your data from frauds and cybercrimes with a completely safe payment experience

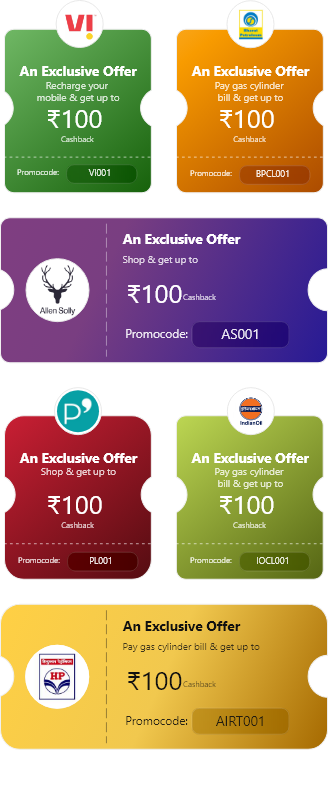

Get rewarded for your transactions

Make your transactions more rewarding with attractive cashbacks and discounts!

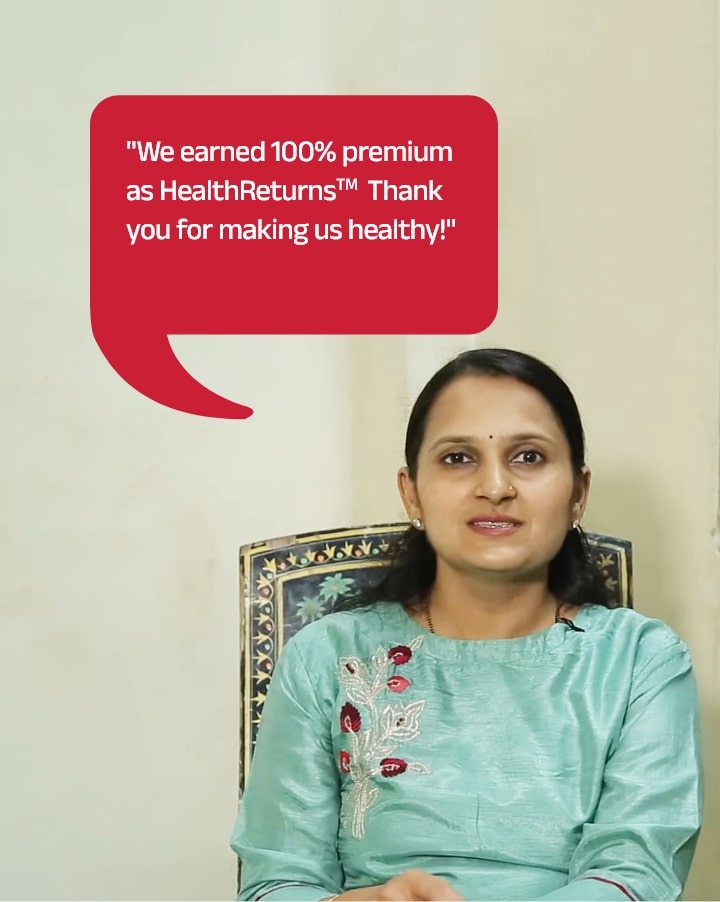

Hear what our customers have to say

Feedback from the voices that drive innovation, inspiration and dedication - our customers

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Duis Mattis, Diam Id . Sit Amet. Donec Velit Massa Pharetra A Elementum Sed Mattis Vel Tortor. Ac Neque Ut Purus Sed Nulla Felis Pharetra. Lobortis Aliquet Tortor Suspendisse Urna Mauris Justo Volutpat Odio. Dignissim Orci Ante Mattis Scelerisque Lacus Amet.

Kavya Mehra

Aditya Birla Health Insurance Customer

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Duis Mattis, Diam Id . Sit Amet. Donec Velit Massa Pharetra A Elementum Sed Mattis Vel Tortor. Ac Neque Ut Purus Sed Nulla Felis Pharetra. Lobortis Aliquet Tortor Suspendisse Urna Mauris Justo Volutpat Odio. Dignissim Orci Ante Mattis Scelerisque Lacus Amet.

Kavya Mehra

Aditya Birla Health Insurance Customer

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Duis Mattis, Diam Id . Sit Amet. Donec Velit Massa Pharetra A Elementum Sed Mattis Vel Tortor. Ac Neque Ut Purus Sed Nulla Felis Pharetra. Lobortis Aliquet Tortor Suspendisse Urna Mauris Justo Volutpat Odio. Dignissim Orci Ante Mattis Scelerisque Lacus Amet.

Kavya Mehra

Aditya Birla Health Insurance Customer

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Duis Mattis, Diam Id . Sit Amet. Donec Velit Massa Pharetra A Elementum Sed Mattis Vel Tortor. Ac Neque Ut Purus Sed Nulla Felis Pharetra. Lobortis Aliquet Tortor Suspendisse Urna Mauris Justo Volutpat Odio. Dignissim Orci Ante Mattis Scelerisque Lacus Amet.

Kavya Mehra

Aditya Birla Health Insurance Customer

FAQs

The maximum amount that can be transferred using the ABCD App is up to ₹1 lakh per day.

Yes, you can use UPI to send money to someone who does not have a UPI ID. You can simply enter the recipient's bank account details to make the payment.

You can ensure the security of your UPI transactions by keeping your UPI PIN and mobile device secure, avoiding sharing your UPI PIN with anyone, and monitoring your account activity regularly.

If your UPI transaction fails, check your account balance, ensure that you entered the correct UPI ID and PIN, and retry the transaction. If the issue persists, contact our customer support for assistance through the ‘Support’ option.

You can also raise a query/complaint for specific transactions through 'Transaction History' through these steps:

-

Click on ‘Transaction History'

-

Click on the specific transaction or click on the 3 dots.

-

Click on the 'Raise issue' option.

No, once a UPI transaction has been initiated, it cannot be cancelled. However, you can lodge a formal complaint by visiting the NPCI website and entering details like transaction ID, UPI ID, bank account details, and bank statement as proof to initiate the dispute redressal process. You will be informed of the updates through the ABCD App itself.

Step 1

Step 2

Step 3

Finish

Investment Recommendations Under 80C

Download the ABCD App

Unlock Financial Tools, Investment Insights, And Expert Guidance – All In One Convenient App.

Get The Link To Download The App

OTP Verfication

Enter the Verification Code sent to

+91-9876543210 CHANGE NUMBERVerification Code sent expires in 59 Seconds

RESEND OTP

1800-270-7000

1800-270-7000

PlayStore

PlayStore

INVESTMENTS

INVESTMENTS  LOANS

LOANS  PAYMENTS

PAYMENTS  QUICK SERVICES

QUICK SERVICES  HEALTH INSURANCE

HEALTH INSURANCE