-

Loans

-

Housing Finance

-

Related Reads

What is Mortgage Loan?

What is Mortgage Loan? Home Improvement Loan: Everything You Need to Know

Home Improvement Loan: Everything You Need to Know What is a Loan Against Property?

What is a Loan Against Property?

-

Personal Finance

-

Personal Loan Eligibility Calculator

Are you eligible for a Personal Loan? Find out now!

CALCULATE NOWRelated Reads What is Personal Loan?

What is Personal Loan? Instant Personal Loan In India – What Is It And How To Apply?

Instant Personal Loan In India – What Is It And How To Apply? Debt Consolidation With a Personal Loan

Debt Consolidation With a Personal Loan

-

SME Finance

-

Related Reads

Types of MSME Loans for Your Business

Types of MSME Loans for Your Business A Guide to Startup Business Loans

A Guide to Startup Business Loans Things to Include In Your Business Loan Application

Things to Include In Your Business Loan Application

- Back

-

Housing Finance

-

Investments

-

Mutual Funds

-

-

Related Reads

Mutual Funds for NRIs: 4 Tax Rules You Should Know

Mutual Funds for NRIs: 4 Tax Rules You Should Know Systematic Investment Plan: Meaning, Advantages & Disadvantages

Systematic Investment Plan: Meaning, Advantages & Disadvantages Liquid Funds – Working, Benefits And Taxation

Liquid Funds – Working, Benefits And Taxation

-

-

Stocks & Securities

-

Related Reads

Understanding Bonds & Types of Bonds

Understanding Bonds & Types of Bonds Working of the trade price in the stock market

Working of the trade price in the stock market What is a Stockbroker? - Types & Their Role in Stock Market

What is a Stockbroker? - Types & Their Role in Stock Market

-

FD & Digital Gold

-

Related Reads

What Is FD? - Complete Guide on Fixed Deposit

What Is FD? - Complete Guide on Fixed Deposit Tax Saving FD - 10 Interesting Facts about Tax Saving Fixed Deposits

Tax Saving FD - 10 Interesting Facts about Tax Saving Fixed Deposits Fixed Deposits (FD) Benefits & Features

Fixed Deposits (FD) Benefits & Features

-

Tax Solutions

-

Related Reads

What Is FD? - Complete Guide on Fixed Deposit

What Is FD? - Complete Guide on Fixed Deposit Tax Saving FD - 10 Interesting Facts about Tax Saving Fixed Deposits

Tax Saving FD - 10 Interesting Facts about Tax Saving Fixed Deposits Income Tax on Interest on Fixed Deposit: What You Need to Know

Income Tax on Interest on Fixed Deposit: What You Need to Know

- Back

-

Mutual Funds

-

Insurance

-

Life Insurance

-

Human Life Value Calculator

Find out how much life insurance you need with our Human Life calculator

CALCULATE NOWRelated Reads What is Insurance ? Your Guide to Understanding Insurance in India

What is Insurance ? Your Guide to Understanding Insurance in India Insurance for Children: Does a Child Need Life Insurance?

Insurance for Children: Does a Child Need Life Insurance? All you need to know about Unit Linked Insurance Plans

All you need to know about Unit Linked Insurance Plans

-

Health Insurance

-

Related Reads

Super Top-Up Health Insurance Cover – All You Need to Know

Super Top-Up Health Insurance Cover – All You Need to Know Health Insurance for Senior Citizens

Health Insurance for Senior Citizens Maternity Insurance Plans – What it is All About

Maternity Insurance Plans – What it is All About

-

Motor Insurance

-

Related Reads

What is Motor Insurance? - Car Coverage, Claims & More

What is Motor Insurance? - Car Coverage, Claims & More Different Types of Car Insurance Policies and Their Coverage

Different Types of Car Insurance Policies and Their Coverage Common Exclusions that Your Car Insurance Will Not Cover

Common Exclusions that Your Car Insurance Will Not Cover

- Back

-

Life Insurance

-

Payments

-

Tools

-

My Track

-

Related Reads

What is Mortgage Loan?

What is Mortgage Loan? All You Need to Know About Mutual Fund Expense Ratio

All You Need to Know About Mutual Fund Expense Ratio Insurance for Children: Does a Child Need Life Insurance?

Insurance for Children: Does a Child Need Life Insurance?

-

ABC Of Money

-

ABC of Money

View All -

Related Reads

What is Mortgage Loan?

What is Mortgage Loan? All You Need to Know About Mutual Fund Expense Ratio

All You Need to Know About Mutual Fund Expense Ratio Insurance for Children: Does a Child Need Life Insurance?

Insurance for Children: Does a Child Need Life Insurance?

-

-

ABC Of Calculators

-

ABC Of Calculators

View All -

Related Reads

What is Mortgage Loan?

What is Mortgage Loan? All You Need to Know About Mutual Fund Expense Ratio

All You Need to Know About Mutual Fund Expense Ratio Insurance for Children: Does a Child Need Life Insurance?

Insurance for Children: Does a Child Need Life Insurance?

-

- Back

-

My Track

-

Quick Services

Life Insurance

Health Insurance

Mutual Fund

Home Finance

Personal Finance

- Personal

- Business

-

Corporates

-

Advisors

-

Investments

- Mutual Funds Advisors

- Stocks & Securities Advisors

-

Complete Money Solutions

- Select Advisor

-

Tools & Calculators

- Calculators

- SIP Calculator

- EMI Calculator

- Flexi Loan

- Money View

- Hybrid Funds

- Fund Of Funds

- Index Funds

Popular Searches

Trending Plans

Most Visited Product

Our Financial Solutions

Life Insurance

Health Insurance

Mutual Funds

Stock & Securities

Housing Finance

Personal Finance

SME Finance

Home Loan

Home Loan

Make your dream of owning a home a reality

Balance Transfer

Balance Transfer

Find a better interest rate for your existing home loan

Top-up Home Loan

Top-up Home Loan

Get the extra cash you need to finance your dream home

Loan Against Property

Loan Against Property

Empower your financial goals with the assets you already own

Construction Finance

Construction Finance

Finance your real estate project from foundation to finish

Quick Links

Related Reads

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

Personal Loan

Personal Loan

Get a Personal Loan instantly without any collateral

Aditya Birla SBI Card

Aditya Birla SBI Card

Get rewarded every time you shop

Flexi Loan

Flexi Loan

Get a flexible loan that adapts to your needs

Quick Links

Related Reads

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

Line of Credit

Line of Credit

Access the funds you need to grow your business

Unsecured Business Loan

Unsecured Business Loan

Get a loan for your business needs without providing collateral

Secured Business Loan

Secured Business Loan

Get loans for all of your business needs at attractive rates

Working Capital Demand Loan

Working Capital Demand Loan

Meet your business’s financial needs from a dependable source

Supply Chain Financing Solutions - Invoice Discounting

Supply Chain Financing Solutions - Invoice Discounting

Ensure your business always has a smooth cash flow

Quick Links

Business Loan EMI Calculator

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis, Diam Id.

CALCULATE NOW

Related Reads

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

Debt Funds

Debt Funds

Mauris Porta Arcu Id Tortor Pulvinar Cursus.

Equity Funds

Equity Funds

Mauris Porta Arcu Id Tortor Pulvinar Cursus.

ETF Funds

ETF Funds

Mauris Porta Arcu Id Tortor Pulvinar Cursus.

Hybrid Funds

Hybrid Funds

Mauris Porta Arcu Id Tortor Pulvinar Cursus.

Fund Of Funds

Fund Of Funds

Mauris Porta Arcu Id Tortor Pulvinar Cursus.

Index Funds

Index Funds

Mauris Porta Arcu Id Tortor Pulvinar Cursus.

Related Reads

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

Calculators View All

SIP Calculator

SIP Calculator

Mauris Porta Arcu Id Tortor Pulvinar Cursus.

EMI Calculator

EMI Calculator

Mauris Porta Arcu Id Tortor Pulvinar Cursus.

Flexi Loan

Flexi Loan

Mauris Porta Arcu Id Tortor Pulvinar Cursus.

Money View

Related Reads

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

Life Insurance

Life Insurance

Mutual Fund

Mutual Fund

Health Insurance

Health Insurance

Home Finance

Home Finance

Personal Finance

Personal Finance

Term Plan

Term Plan

Bring security and peace to life’s unpredictability

Retirement Plan

Retirement Plan

Get a guaranteed regular pension plus a lump sum on plan maturity

Savings Plan

Savings Plan

Build wealth over time with disciplined savings

Child Plan

Child Plan

Ensure your child’s future with a combo of investment and insurance

ULIP

ULIP

Get the benefits of insurance and wealth creation in one convenient plan

Related Reads

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

Related Reads

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

Mutual Fund Lumpsum Calculator

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis, Diam Id.

CALCULATE NOW

Related Reads

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

Open Demat Account

Open Demat Account

Create a Demat Account and start investing

IPO Calender

IPO Calender

Stay up-to-date with current and upcoming IPOs

Quick Links

Related Reads

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

Debt Funds

Debt Funds

Diversify your portfolio and reduce risk with Debt Funds

Equity Funds

Equity Funds

The smart way to invest in the stock market

ETF Funds

ETF Funds

Invest easily, diversify wisely, and grow your wealth

Hybrid Funds

Hybrid Funds

Strike the perfect balance between growth and stability

Fund Of Funds

Fund Of Funds

Maximise your returns with Fund of Funds

Index Funds

Index Funds

Follow the benchmark of smart investors to grow your wealth

Mutual Fund Lumpsum Calculator

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis, Diam Id.

CALCULATE NOW

Related Reads

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

All You Need To Know About Insurance Policy

Mauris Porta Arcu Id Tortor Pulvinar Cursus. Mattis

Popular Searches

Trending Plans

Our Financial Solutions

Life Insurance

Health Insurance

Mutual Funds

Stock & Securities

Housing Finance

Personal Finance

SME Finance

Related Reads

All You Need To Know About Insurance Policy

All You Need To Know About Insurance Policy

Step 1

Step 2

Step 3

Finish

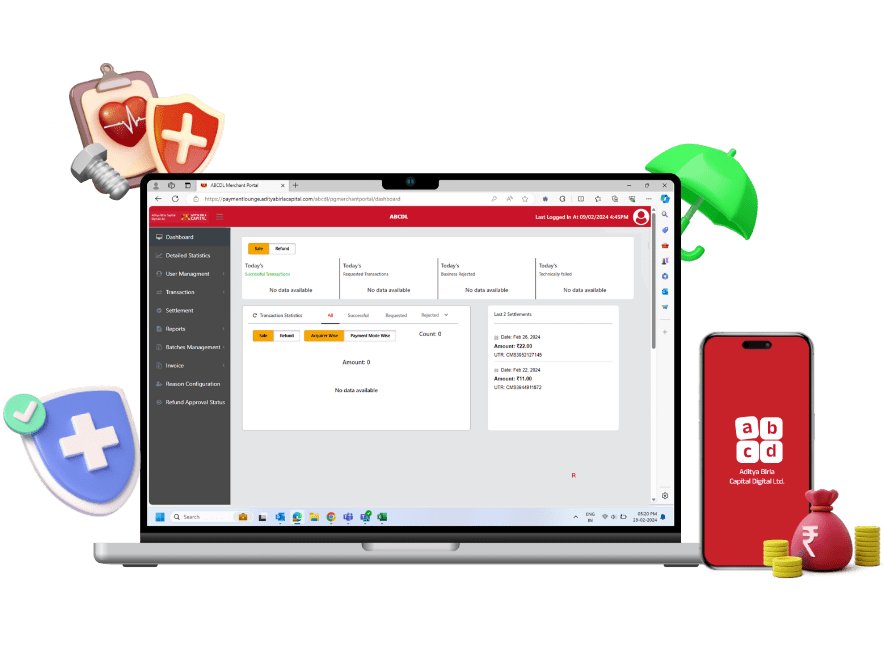

Seamless, Secure and Efficient Solutions for Accepting Online Transactions

A multimodal collection platform for your business with easy customisation and integration of different payment gateways.

Reason to choose ABCD App for your business

ABCD App is the one-stop solution for all your business payment needs. Know why to choose us.

Payment Lounge Comparison With Others

| FEATURES | PAYMENT LOUNGE | OTHER PAYMENT AGGREGATORS |

|---|---|---|

| PCI Compliant Tokens For Saved Card Transactions |  |

|

| Unified Apis For All Aggregators | Available (Android And IOS) |

|

| Payments SDK |  |

|

| Custom And On-Demand Integrations For Merchants |  |

|

| OTP Reading And Auto Submission |  |

|

| Published Uptime And Strict Slas |  |

|

| Unified Dashboard For Ops And Analytics |  |

|

ABCD App On Desktop & Mobile

-

Payment lounge hosted checkout

-

Merchant hosted checkout

-

Android SDK

-

iOS SDK

-

React Native SDK

-

Flutter SDK

Trusted by India's Top Brand

Lorem ipsum dolor sit amet consectetur adipisicing elit. Laborum consectetur illo deserunt aperiam, distinctio provident in! Suscipit nulla nisi quod aliquid, atque, asperiores doloremque quae eum, excepturi adipisci quisquam eos?

Kiran Sharma

CTO, XYZ Company

Lorem ipsum dolor sit amet consectetur adipisicing elit. Laborum consectetur illo deserunt aperiam, distinctio provident in! Suscipit nulla nisi quod aliquid, atque, asperiores doloremque quae eum, excepturi adipisci quisquam eos?

Kiran Sharma

CTO, XYZ Company

Lorem ipsum dolor sit amet consectetur adipisicing elit. Laborum consectetur illo deserunt aperiam, distinctio provident in! Suscipit nulla nisi quod aliquid, atque, asperiores doloremque quae eum, excepturi adipisci quisquam eos?

Kiran Sharma

CTO, XYZ Company

Lorem ipsum dolor sit amet consectetur adipisicing elit. Laborum consectetur illo deserunt aperiam, distinctio provident in! Suscipit nulla nisi quod aliquid, atque, asperiores doloremque quae eum, excepturi adipisci quisquam eos?

Kiran Sharma

CTO, XYZ Company

Lorem ipsum dolor sit amet consectetur adipisicing elit. Laborum consectetur illo deserunt aperiam, distinctio provident in! Suscipit nulla nisi quod aliquid, atque, asperiores doloremque quae eum, excepturi adipisci quisquam eos?

Kiran Sharma

CTO, XYZ Company

Aditya Birla’s trust you can rely uponwith confidence

Trust

Bank on Aditya Birla’s trusted platform as your payment partner for hassle-free transactions.

Security

Experience secured payment gateways and pay without worries!

Safety

Protect your data from frauds and cybercrimes with a completely safe payment experience

FAQs

Payment Lounge is a multi-modal & omni channel collections platform for merchants, with customization & smart routing capabilities through multiple payment gateway.

Merchant will get onboarded on the Payment Lounge platform, offering is an online and digitally enabled payment service that helps you process online payments made by various modes, including credit cards, debit cards and other card payment.

Smart routing will be the key feature available on Payment Lounge along with the payment processing, smart routing will help the merchants to route the traffic based on their requirement within the existing PA/PG. PL will identify and route the transactions based on higher success rate of the mode of payment or the basis of the lower commercials of the mode of payment used while doing the transaction.

This will help the merchants to enhance the existing success rate and will be cost effective because of the smart routing functionality, Payment Lounge will be charging a smart routing cost to the respective merchants as a cost is involved for Payment Lounge in terms of integration, maintenance, and product development.

It comprises a wide range of payment products each of which can support your business in accepting digital payments. These include: Router, Payment links (Via Portal and API), Web integration, APK, Bulk upload alert triggering, Customised alert for type of collection, Amount editable option, split payment.

How to integrate payment lounge on my website? Which platforms does it support?

The process of integrating payment Lounge is quite easy. You can use developer-friendly APIs for seamless integration and start accepting online payments. It is usable across desktop, mobile web, and Android/iOS devices.

Payment Lounge supports the widest range of payment sources, including Credit and Debit Cards (Visa, Mastercard, AMEX, Rupay), Net Banking from top 50+ banks, UPI, Wallets.

Payment Lounge is highly valuable for individuals handling small or big businesses, e-commerce shops/apps, local vendors, freelancers, educational institutions, and more.

Step 1

Step 2

Step 3

Finish

Investment Recommendations Under 80C

Download the ABCD App

Unlock Financial Tools, Investment Insights, And Expert Guidance – All In One Convenient App.

Get The Link To Download The App

OTP Verfication

Enter the Verification Code sent to

+91-9876543210 CHANGE NUMBERVerification Code sent expires in 59 Seconds

RESEND OTP

1800-270-7000

1800-270-7000

PlayStore

PlayStore

INVESTMENTS

INVESTMENTS  LOANS

LOANS  PAYMENTS

PAYMENTS  QUICK SERVICES

QUICK SERVICES  HEALTH INSURANCE

HEALTH INSURANCE