When you are in your 20s and 30s, retirement might be the last thing on your mind, but the sooner you start thinking about a game-plan for the future, the less you’ll need to worry about it as it approaches.

Importance of planning for retirement

Unlike other developed countries, we do not have financial schemes such as social security to fall back on. Also, except for a few who work with public sector organizations, most people cannot depend on their employers for health care benefits for life.

One must bear in mind that healthcare costs increase exponentially as one age, thus adding to the burden during retirement. This coupled with inflation, which is rising steadily creates a strong reason to start planning for retirement as early as possible.

Here is how you can start preparing for retirement:

1. Financially educate yourself

It is essential to understand and know the difference between a wide range of investment products and services available in the market. Remember it is your money and you need to know what’s happening with it. So make sure to ask questions to your CA and financial planner. You can also choose to read a few books or visit websites on finance and investment.

2. Cut out your debt

Remember there are different types of debt, for example – you might have a high-interest credit card debt which should be paid off first as its putting the maximum drain on your finances. So make sure to pay the most expensive debt first.

3. Convert your savings to income

Your savings if kept in a regular bank account will give you a very low rate of interest. Instead, you could choose to invest it in a host of financial products such as Fixed Deposits, Mutual Funds, etc. Your financial advisor would be able to suggest the most appropriate investments based on your risk appetite and investment goals.

4. Keep your lifestyle in check

Often we tend to buy objects that are not required and create unnecessary debt. An important aspect of improving your finances is to avoid lifestyle inflation by buying expensive objects.

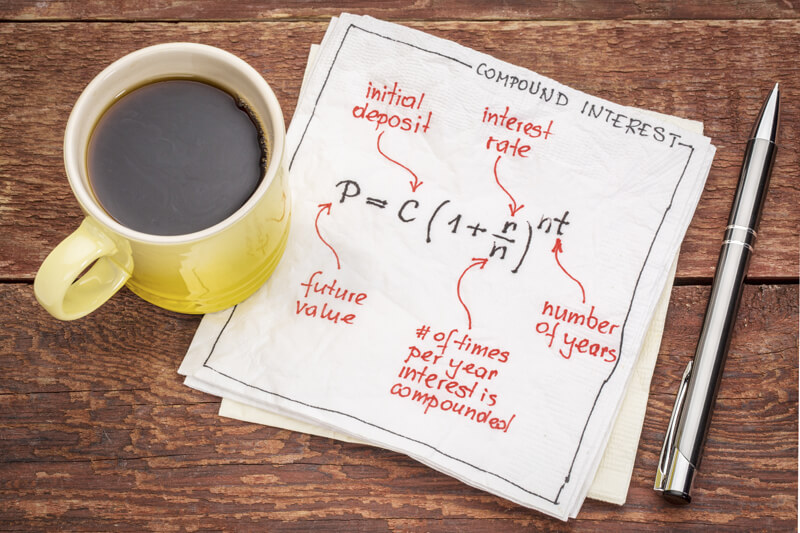

5. Take advantage of compound interest

Albert Einstein called compound interest ‘the greatest mathematical discovery of all time’. Simply put, in compound interest, the interest is added to the principle of a deposit. So you also earn interest on the interest of your original investment. Remember, the earlier you begin, the greater the power of compounding.

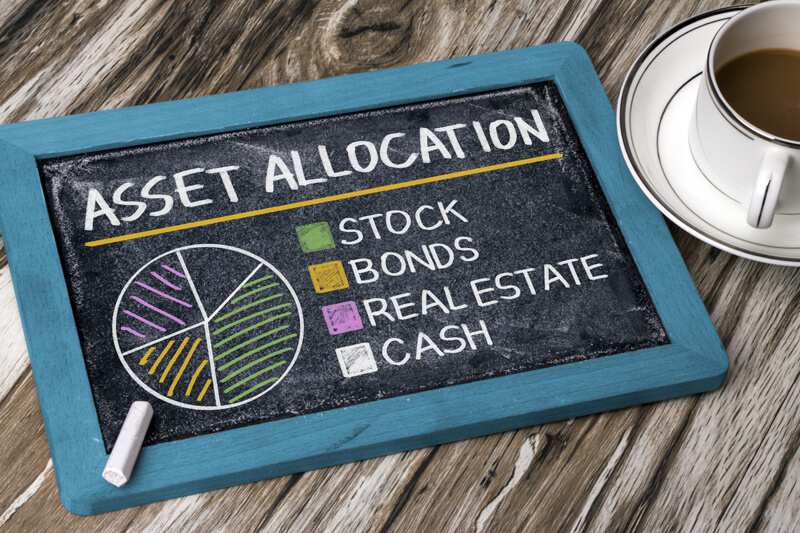

6. Invest in assets

An asset is defined as something that would give you returns, for example, if you had to choose between buying the latest phone or investing the amount in the stock of a growing company, the latter would give you returns whereas the former would depreciate in value.

So make sure to invest in assets which increase in value rather than lose value.

7. Get adequate health insurance

While no one plans to get sick, we all would need medical/health care in the event of a critical illness. And the rising cost of hospitalisation is likely to burn a hole in your wallet. Getting a good health insurance cover can protect you from unexpected, high medical bills. So make sure you get health insurance.

1800-270-7000

1800-270-7000