- Products

- Health & Wellness plans

- Comprehensive Product + PortUp to 100% premium back + Durable equipment cover + Up to 5-year tenure₹9,952*/annumView Details

- Comprehensive ProductHealthReturns™ + No Capping on Medical Expenses + Super Reload₹6,177*/annumView Details

- Tailored ProductHealthReturns™ + No Capping on Medical Expenses + Super Reload₹5,630*/annumView Details

- Max Protection + ChronicHealthReturns™ + Day 1 Cover for 7 Conditions + Chronic Management Program ₹7,111*/annumView Details

- Max ProtectionUp to Rs. 95* lakh coverage with an affordable premium₹962*/annumView Details

- Max ProtectionHealth Insurance + Health Benefits + Rewards₹6,863*/annumView Details

*Starting Plan price mentioned on the website are for self customer with age 30 and Sum Insured 5 LAKH.

#5% discount from 4th policy year to 7th policy year. 10% discount from 8th policy onwards, will be available at renewal.

- Large payout plans

- Health insurance for cover against accidents₹212*/annumView Details

- Health insurance for cover against cancer₹428*/annumView Details

- Protecting your future after a critical illness₹5,463*/annumView Details

*Starting Plan price mentioned on the website are for self customer with age 30 and Sum Insured 5 LAKH.

#5% discount from 4th policy year to 7th policy year. 10% discount from 8th policy onwards, will be available at renewal.

- Corporate Plans

- Comprehensive corporate health insurance planView Details

- Fixed benefit plans including personal accident insurance, critical illness insurance and hospital cash benefitView Details

- The perfect travel insurance planView Details

*Starting Plan price mentioned on the website are for self customer with age 30 and Sum Insured 5 LAKH.

#5% discount from 4th policy year to 7th policy year. 10% discount from 8th policy onwards, will be available at renewal.

- International Cover

- Avail cashless treatment internationally with this plan₹12,917*/annumView Details

*Starting Plan price mentioned on the website are for self customer with age 30 and Sum Insured 5 LAKH.

#5% discount from 4th policy year to 7th policy year. 10% discount from 8th policy onwards, will be available at renewal.

- View allApply Now

- Back

- Health & Wellness plans

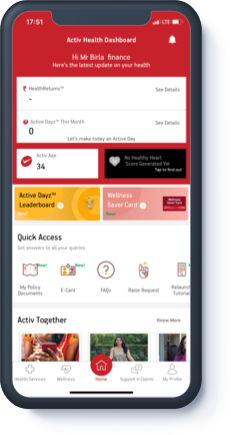

- Health Corner

- Claims

- Hospital Network

- Quick Quote

- Customer Support

- My account

My Profile

Quick Links

Grievance

- Support

- Create your Health ID

- Corporate

- Become an Advisor

- Whatsapp

- Port in to ABHI

- Contact us

- Self Servicing

- Back

- My account

1800-270-7000

1800-270-7000